Design

business.gov.au branding

No branding

Breakpoints:

Currently displaying the mobile design.

To see designs for other breakpoints please view this page on a larger screen.

Results accordion - grey

Foreign investments of a certain kind within defined thresholds require approvals from the Foreign Investment Review Board. Approvals are subject to national interest concerns.

For more information see the fact sheet.

Relevant authority: Foreign Investment Review Board

If your project involves foreign involvement in Australia’s critical infrastructure through investment, third party contractual arrangements and supply chains, you must comply with this Act.

For more information see the fact sheet.

Relevant authority: Department of Home Affairs

Results accordion - yellow

You must be registered for PAYG withholding before you need to withhold tax amounts from payments such as:

- the wage or salary payments you make to employees

- payments to directors

- payments to businesses that do not quote their ABN to you

- royalty, dividend or interest payments to non-residents

- investment income payments to Australian residents (if you're an investment body).

You must then forward these tax amounts to the Australian Taxation Office (ATO).

PAYG withholding isn't a tax on your business - it's a tax on your employees' income that you help the ATO to collect.

Check to see if you need to register for PAYG withholding on the ATO website.

As an employer, if you give certain fringe benefits to your employees, you must pay tax on the value of the fringe benefits.

You'll need to register for FBT before you start providing these benefits.

Visit the Australian Taxation Office (ATO) website to:

- find out what types of fringe benefits you must pay tax on

- check if you need to register for FBT.

Breakpoints:

Currently displaying the mobile design.

To see designs for other breakpoints please view this page on a larger screen.

Apply your brand specific colours, borders and button styles to the base tool result components shown below.

Results accordion

Foreign investments of a certain kind within defined thresholds require approvals from the Foreign Investment Review Board. Approvals are subject to national interest concerns.

For more information see the fact sheet.

Relevant authority: Foreign Investment Review Board

If your project involves foreign involvement in Australia’s critical infrastructure through investment, third party contractual arrangements and supply chains, you must comply with this Act.

For more information see the fact sheet.

Relevant authority: Department of Home Affairs

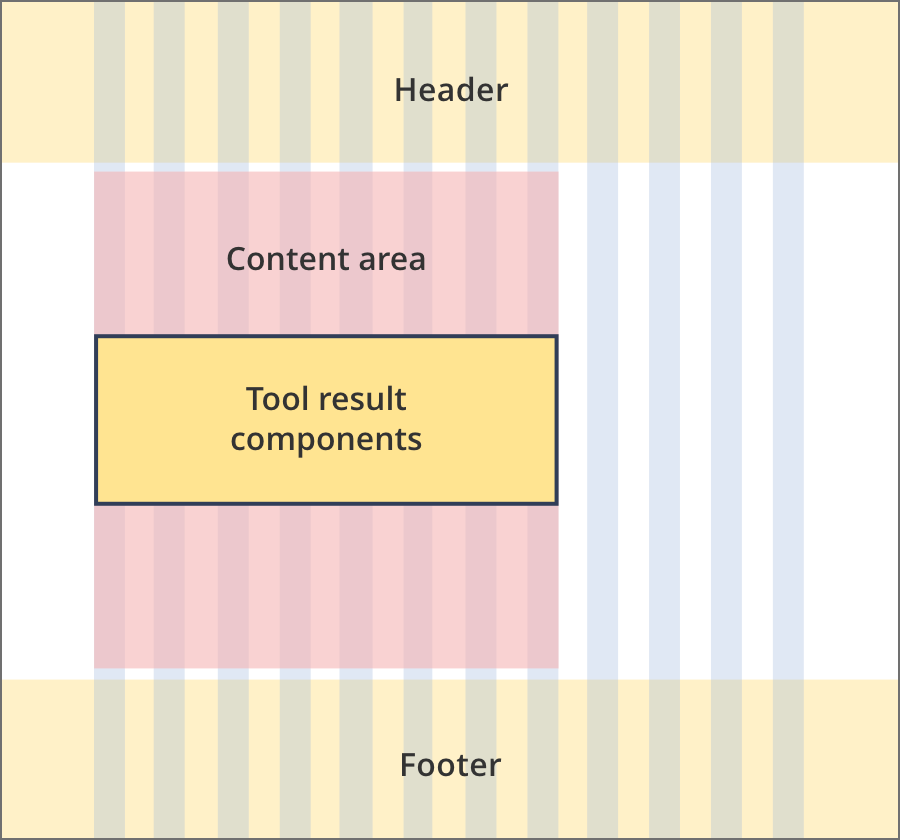

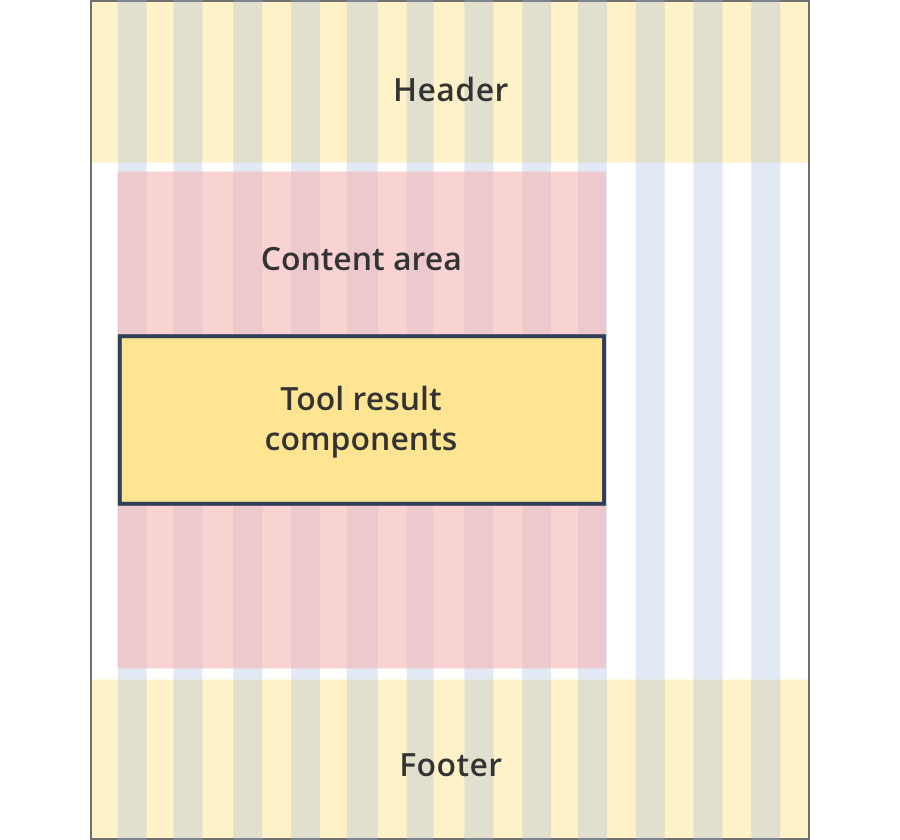

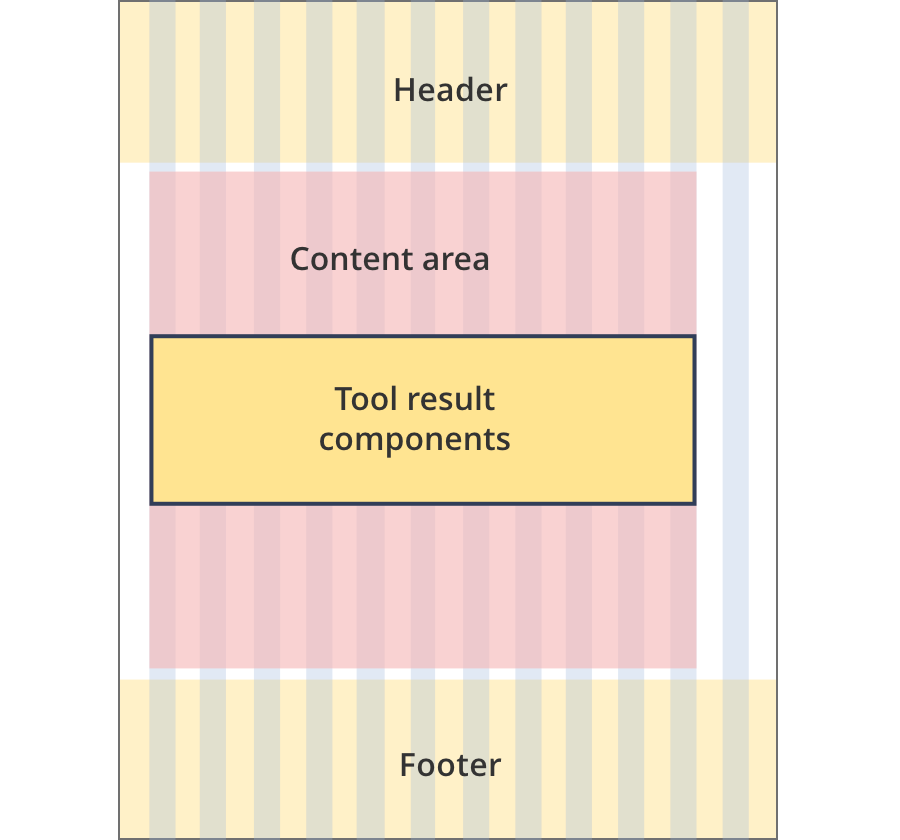

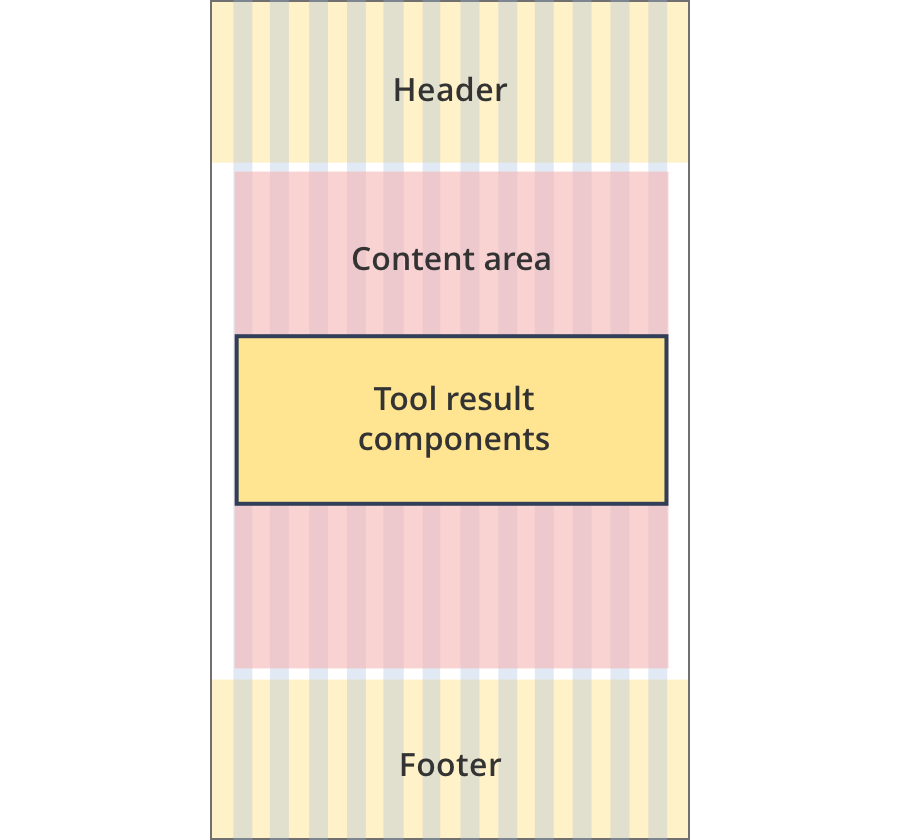

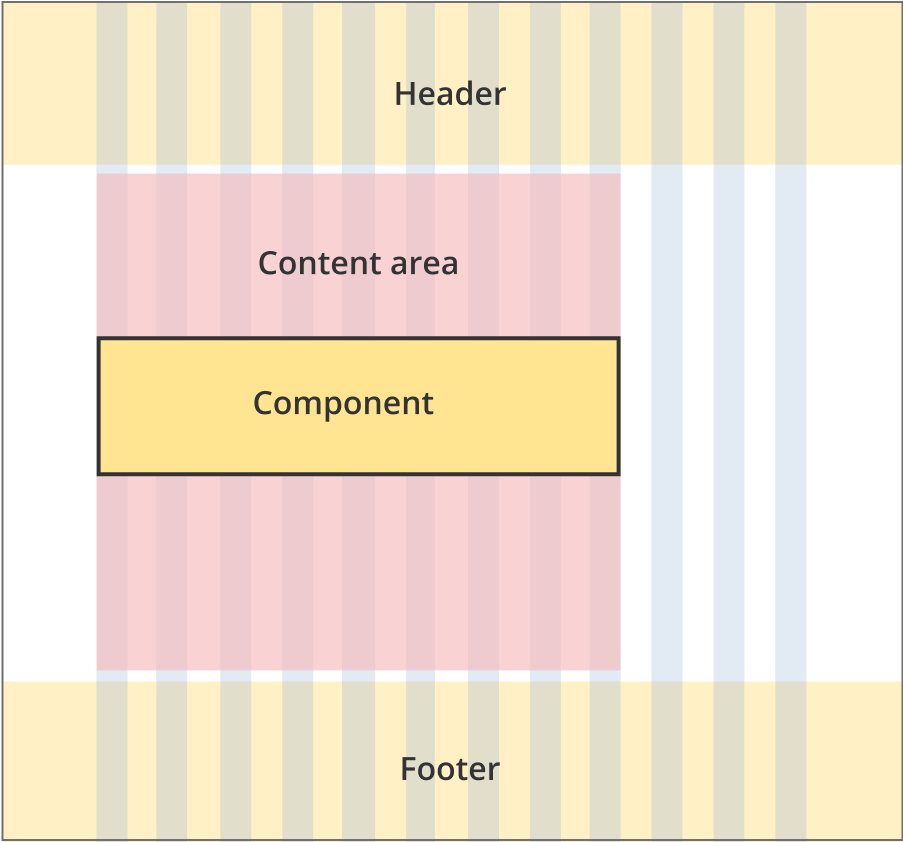

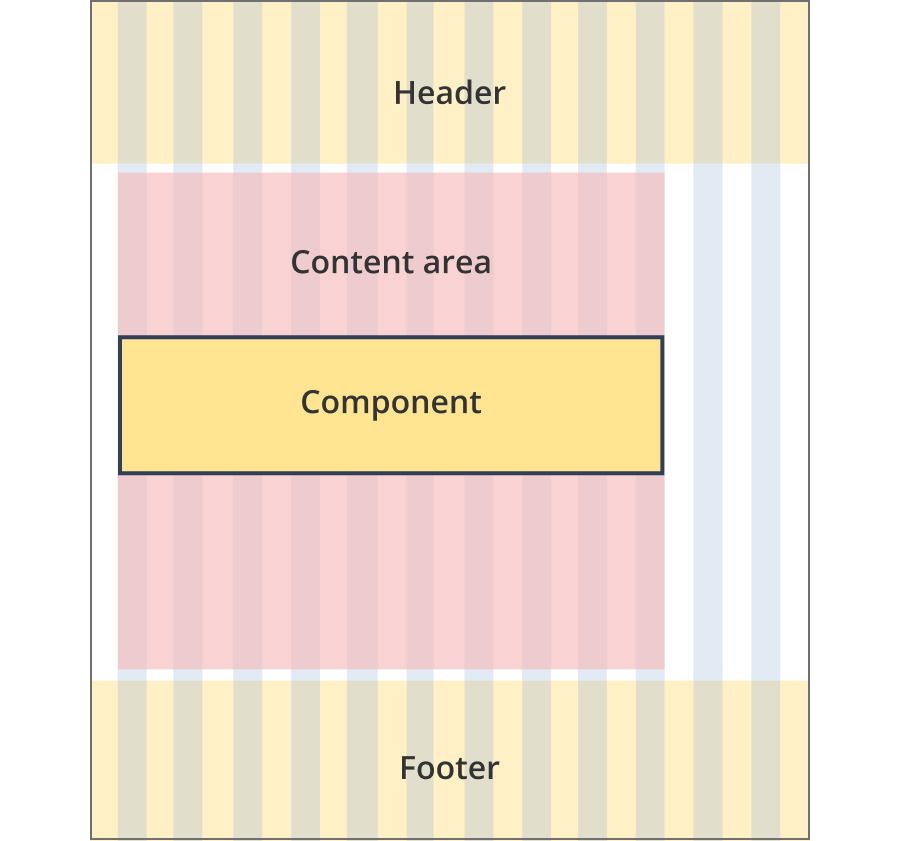

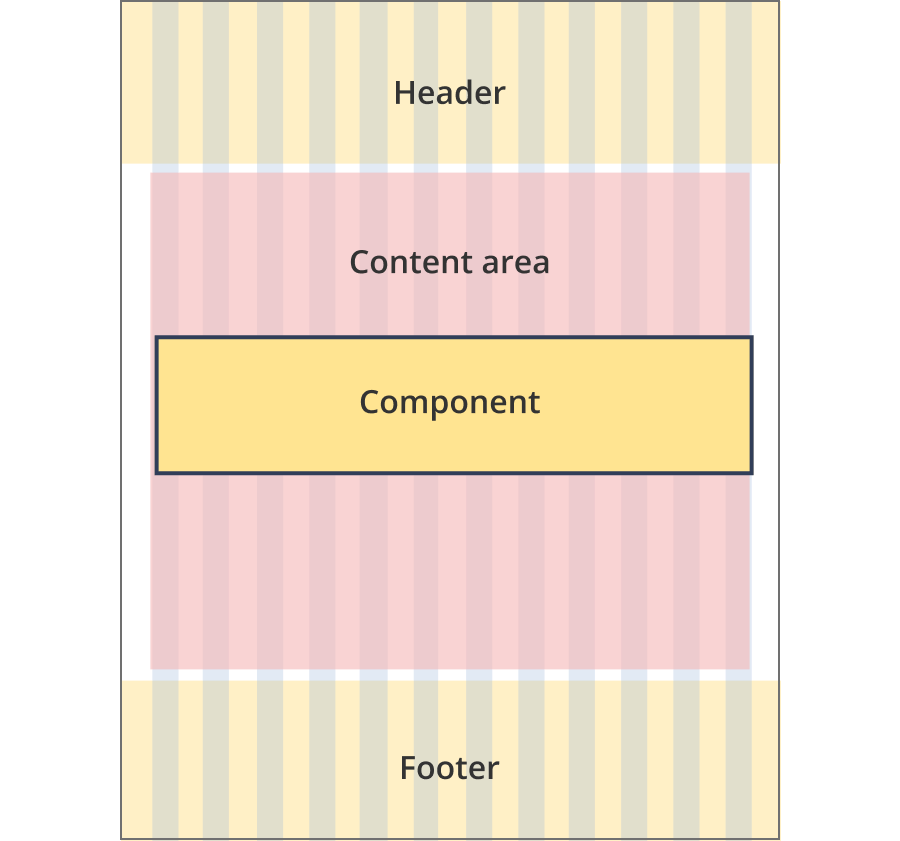

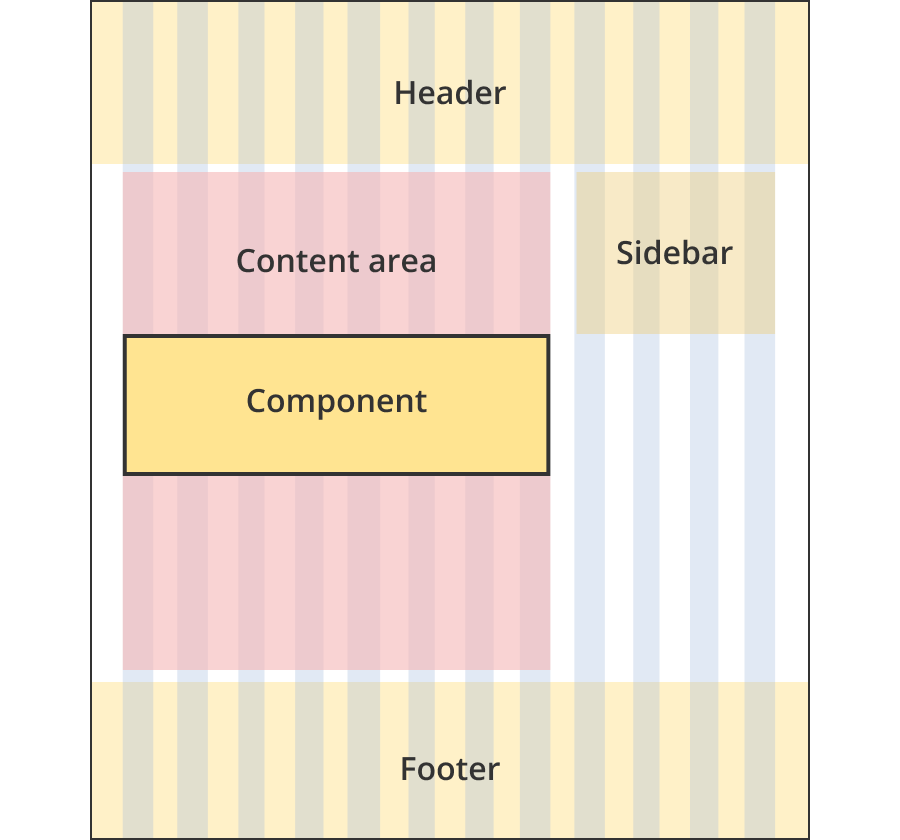

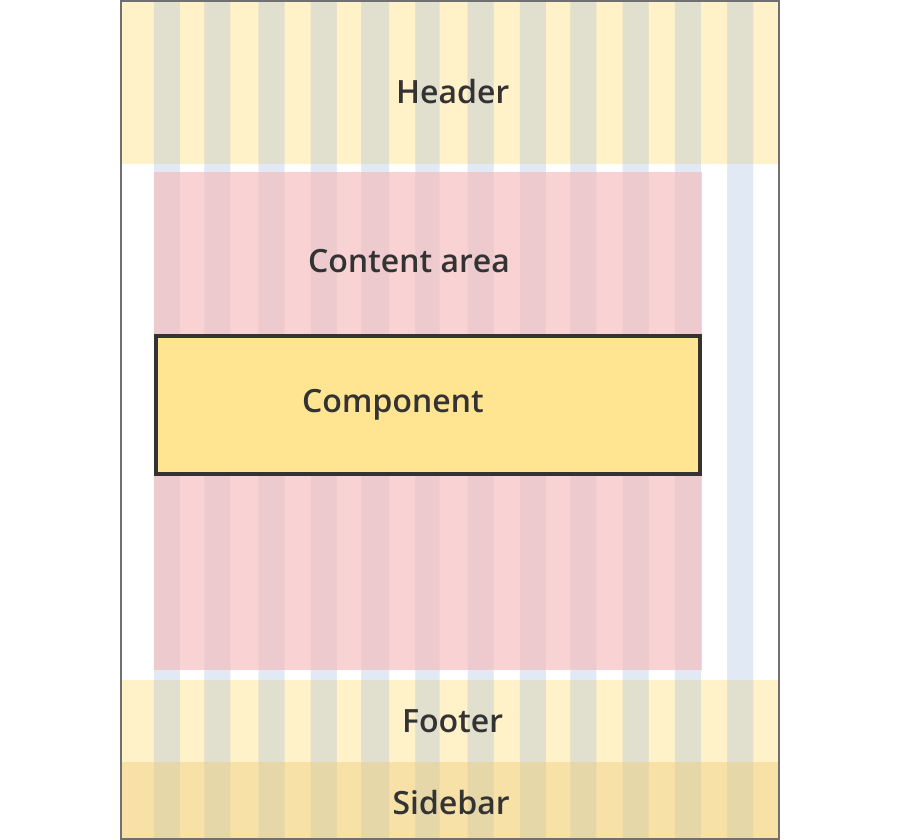

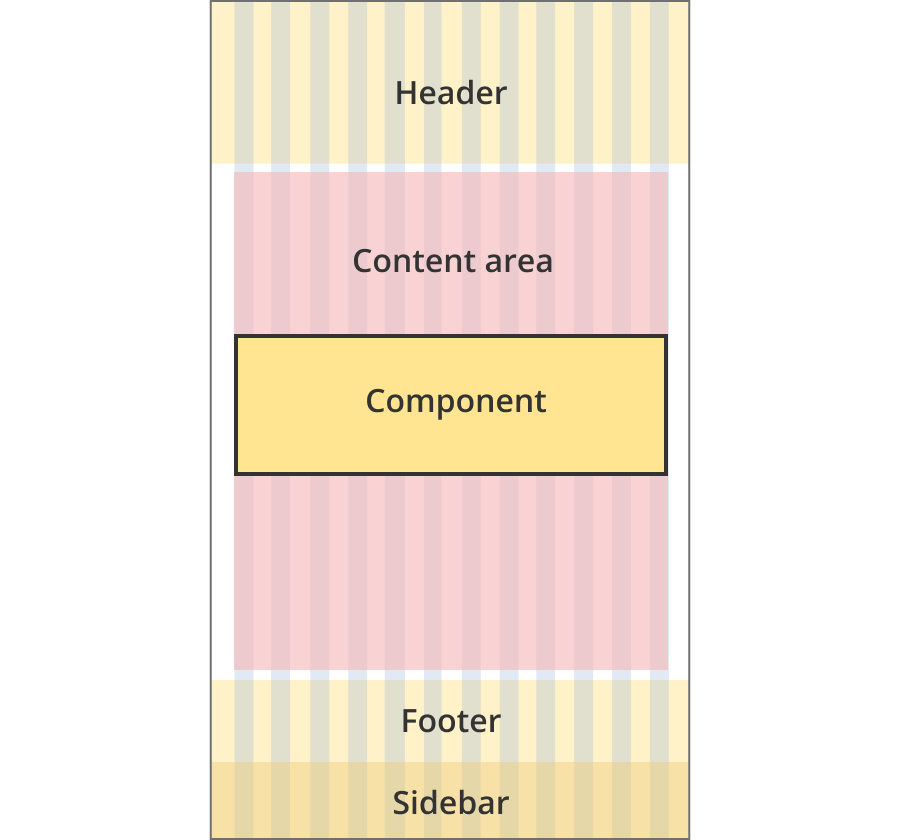

Layouts

Tool result components can be used on the Single column - information page layout, the Single column - tool page layout and the Two column - tool page alternate layout.

Layout:

The content area is 8 grid-columns wide.

Tool result components span the full width of the content area.

The content area is 9 grid-columns wide.

Tool result components span the full width of the content area.

The content area is 11 grid-columns wide.

Tool result components span the full width of the content area.

The content area is 12 grid-columns wide.

Tool result components span the full width of the content area.

The content area is 9 grid-columns wide.

Tool result components span the full width of the content area.

The content area is 10 grid-columns wide.

Tool result components span the full width of the content area.

The content area is 12 grid-columns wide.

Tool result components span the full width of the content area.

The content area is 8 grid-columns wide.

Tool result components span the full width of the content area.

The content area is 11 grid-columns wide.

Tool result components span the full width of the content area.

The content area is 12 grid-columns wide.

Tool result components span the full width of the content area.

Guidelines for use

Purpose:

Results components allow the user to review and edit results from a process or tool they have stepped through. Edit links return the user to the appropriate page in a tool so they can change their answer.

When to use these components:

- Used at the end of business.gov.au tools

Version history

6 June, 2024

- Split the tool results components page into 4 separate pages.

5 March, 2024

- Removed the 'learn more' section from the results call out.

19 September, 2023

- Added a new design pattern, the results call out.

- Added an alternative colour version for the results accordion ('results accordion - yellow').

18 August, 2023

- Update all edit buttons from lowercase 'e' to uppercase 'E'.